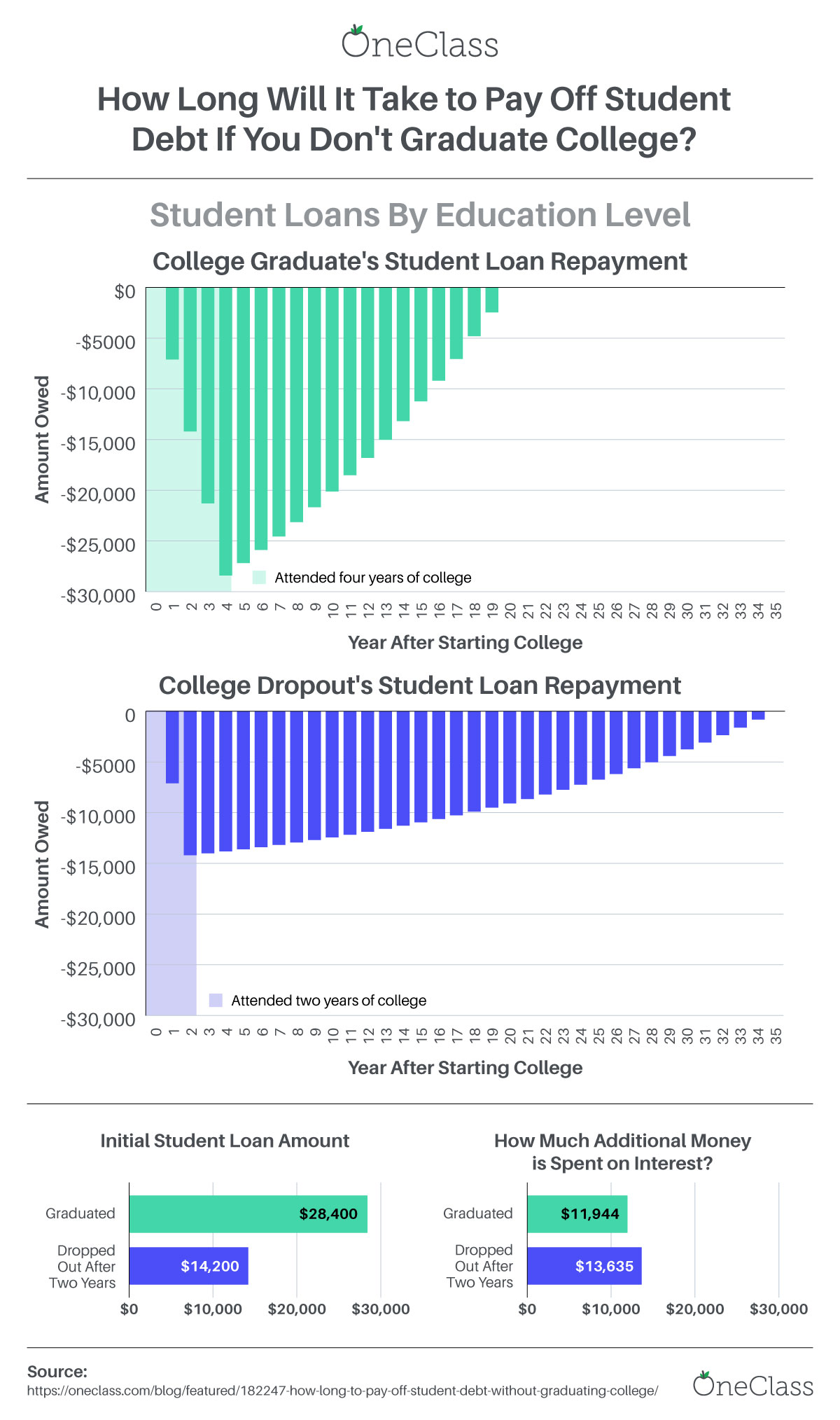

Once you leave college, you will typically have a very significant amount of debt. On average, college saddles people with about $7,100 in student debt per year. Whether you don’t end up graduating or you go through all four years of college, you’re almost certainly going to end up with a lot of debt to pay off after you leave. Here are the most important differences between paying off student debt as a non-graduate versus as a graduate.

How Long Will It Take to Pay Off Student Debt If You Don’t Graduate College? Created By: OneClass

1. The Amount of Debt You Have

One of the most obvious differences for student loans has to do with how much you end up having to pay off. Obviously, at around $7,100 per year, you’ll end up with less student debt if you decide to leave before you graduate, and that’s one thing that might be a factor in some individuals’ decisions to drop out. However, this actually isn’t as impactful as you might think because of the next factor.

2. The Minimum Payments You Can Make

Although it’s not recommended to make only minimum payments on a loan, many people do it anyway, or only pay very slightly more than these minimum payments. That results in a loan that takes many more years to pay off. According to the U.S. Bureau of Labor Statistics, those with a bachelor’s degree earn about 49% more than people who only have “some college” experience. That means you can make higher monthly payments, paying off your loan more quickly.

3. The Interest Rates You Can Get

Interest rates can also have a big impact on the length of time it takes to pay off your debt. Many repayment plans have around a 4.66% interest rate, which isn’t very high, but it adds up significantly over time. Some people may be able to refinance their loans to a lower rate. However, those with a college degree are also more likely to be able to get a refinancing on their student loans, which makes it more difficult for anyone who may not have that degree.

4. The Length of Time It Takes to Pay Off the Debt

All of these elements add up to the most important part: the length of time it takes to pay off your debt. A student who only went through two years of college will end up with $14,200 of debt on average, but make lower payments and pay $13,653 in interest, meaning they may make payments for 34 years before paying their debt off. A student who went through all four years of college will end up with $28,400 in debt on average, but make higher payments and pay $11,944 in interest, meaning they may pay off their debts in 19 years.

How to Avoid Significant Student Loans After Leaving College

Avoiding these student loans after you leave college isn’t necessarily easy. One option is to join groups calling for reduced or completely free college tuition; this can help you and the students who come after you. It’s also a good idea to look for studying materials and resources that can help you stick it out and get through your degree so you can pay off your loans more quickly.

Conclusion

As you can see, student loans can be very impactful for anyone, whether or not they graduate. However, graduation makes it easier for you to repay those loans more quickly and easily. Make sure you access as many study materials as possible so you can graduate and repay your loans over the next few decades.